Getting ready for climate-related financial disclosures

A mandatory climate-related financial disclosure regime for Australia has now been finalised. We outline the changes, consider the impacts and challenges of the new regime and offer some advice on how to best prepare for their imminent enforcement.

The new mandatory climate-related financial disclosures regime comes into effect from 1 January 2025, and it is already having an impact. From our future electricity demand and energy trading advisory work, Marsden Jacob is seeing numerous Australian corporations seeking to achieve 100% renewable electricity effective from 1 January. The falling baselines under the Safeguard Mechanism following recent reforms are also influencing decision-making by major energy users, where we see a shift towards reducing carbon emissions in preference to purchasing carbon offsets.

We note that the substance of climate-related disclosures is different to that of accounting standards, both in terms of terminology, approach and time dimension. This requires a dedicated and specific skill set which, Marsden Jacob is well placed to provide.

Background

In September 2024, the mandatory climate-related financial disclosure regime for Australia was finalised by governments and regulators under Commonwealth climate legislation and new disclosure standards are being finalised by the Australian Accounting Standards Board (AASB)1 and the Department of Finance. These standards bring Australia in line with international climate financial disclosure standards2, initially developed by the Task Force on Climate-related Financial Disclosures (TCFD), that are already applicable in the EU, UK, New Zealand and Japan.

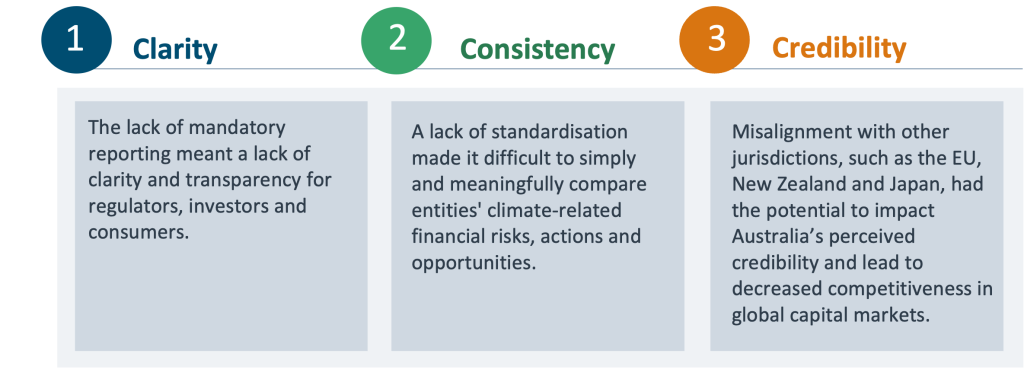

Why is the regime being introduced?

The mandatory climate-related financial disclosure regime is being introduced to help address challenges including:

Who is covered?

- In its first phase (from 1 January 2025), the new regime applies to very large corporations (listed and unlisted), high emissions entities meeting the threshold under the National Greenhouse Energy Reporting (NGER) Act, and some Commonwealth Government entities.

- Over a transition period, the regime is to be extended to most large corporations and other Commonwealth entities.

- Small and medium businesses, charities and not-for-profit organisations will be exempt.

- A TCFD-consistent framework is also expected to be developed by states and territories, and this would apply to local governments.

What needs to be done?

The new information that must be disclosed under the proposed regime includes:3

- Governance, strategy, risk management and metrics and targets.

- Climate resilience assessments. These must incorporate qualitative and quantitative consideration of the impacts of at least two possible future scenarios, one of which must align with limiting global warming to 1.5 degrees.

Climate-related financial disclosures will form part of annual financial reporting obligations and be contained in an entity’s annual report.

What are the potential impacts?

New requirements for liable entities to set emission targets, to report on those targets and on climate-related risks more broadly, can be expected to result in far-reaching changes in future decision-making, with impacts including:

- Large parts of capital markets, which are also liable under the new regime, will be better able to price climate-related risks and opportunities in their investment (and divestment) decisions.

- Asset portfolios may be repriced where risks (positive and negative) are made more evident.

- For emissions-intensive companies where a substantial portion of current corporate revenue and value could be economically stranded, capital markets may respond by amending risk pricing for climate.

- The new disclosures may increase pressure from customers, counterparties and suppliers for more rapid decarbonisation.

- Regulators will be better able to assess and manage systemic risks to the financial system because of climate change, and the efforts being taken to mitigate its impacts.

What are the challenges?

Navigating these changes will be a challenge for many liable entities, especially those with large carbon footprints or higher exposure to climate change impacts, for example, via emissions or climate-vulnerable assets. Companies and Commonwealth entities need to change and adapt their current decision-making and governance systems, capital allocation, risk management, business models, performance target setting, financial reporting systems and processes, and communications with shareholders, customers and counterparties.

In anticipation of the new disclosure regime, many large Australian companies have already been improving their climate-related financial disclosures and reporting. From our future electricity demand and energy trading advisory work, we are seeing numerous Australian corporations seeking to achieve 100% renewable electricity effective from calendar 2025 – when the new disclosure regime takes effect.

We recommend that entities not in the first tranche of liable entities, such as local governments, begin preparing to operate under new mandatory climate financial disclosure requirements, even where the exact details of these requirements may not have been fully specified. Early preparation could avoid the potential for capital and operating decisions that may turn out to be imprudent once a new mandated climate-related financial disclosure regime applies.

How Marsden Jacob can help

New requirements for liable entities to set emission targets, to report on those targets and on climate-related risks more broadly, can be expected to result in far-reaching changes in future decision-making, with impacts including:

Key contacts

To learn more about the new climate-related financial disclosure regime, and how to make decisions that will help you shape the future wisely, contact our expert team.

Associate Director

Associate Director